Ashley Has an Individual Medical Expense Insurance

March 29 2022. The fear isnt necessarily surprising given annual studies showing what a substantial cost health care expenses in retirement can be.

Get What S Yours For Health Care How To Get The Best Care At The Right Price The Get What S Yours Series Moeller Philip 9781982134259 Books

Ashley had outpatient surgery to remove a bunion on her foot and incurred medical bills of 10000.

. - health insurance exchange for individuals and small groups - Medicaid - individual mandate Uninsured individuals annual penalty greater of. The Health Insurance Portability and Accountability Act of 1996 allowed for premiums paid on long-term care insurance policies to qualify as a deductible medical expense. Ashley had outpa- tient surgery to remove a bunion on her foot and incurred medical bills of 10000.

The Administrative Services team oversees all aspects of medical insurance billing and medical records at CU Boulder. Health Insurance as a Business Expense. AQ 6 - Ashley has an individual medical expense insurance policy with a 1000 calendar-year deductible and a 80-20 coinsurance clause.

Which means in total the couple can claim 3200 1530 4730 of long-term care insurance premiums as deductible medical expenses. As a result families can become members in healthcare sharing programs for 300 to 500 per month compared to the average unsubsidized cost of family traditional health insurance coverage at 1564 per month and its easy to see the savings appeal for those who lack generous employer coverage or do not qualify for government premium. 75 of AGI.

Ashley had outpatient surgery to remove a bunion on her food and incurred medical bills of 10000. Ashley has an individual medical expense insurance policy with a 1000 calendar-year deductible and a 20 coinsurance clause. If you have any questions about medical insurance billing or medical records please contact one of the Admin.

Other good plans have ample medical coverage of. Below is the team dedicated to ensuring students receive the highest quality primary care experience possible. Best Individual Health Insurance.

To the extent that 4730 when added to other medical expenses exceeds 10 of the couples AGI the excess above the threshold will be. The most generous travel insurance plans provide 500000 per person for emergency medical expenses and 1 million for emergency medical evacuation. Ashley had outpatient surgery to remove a.

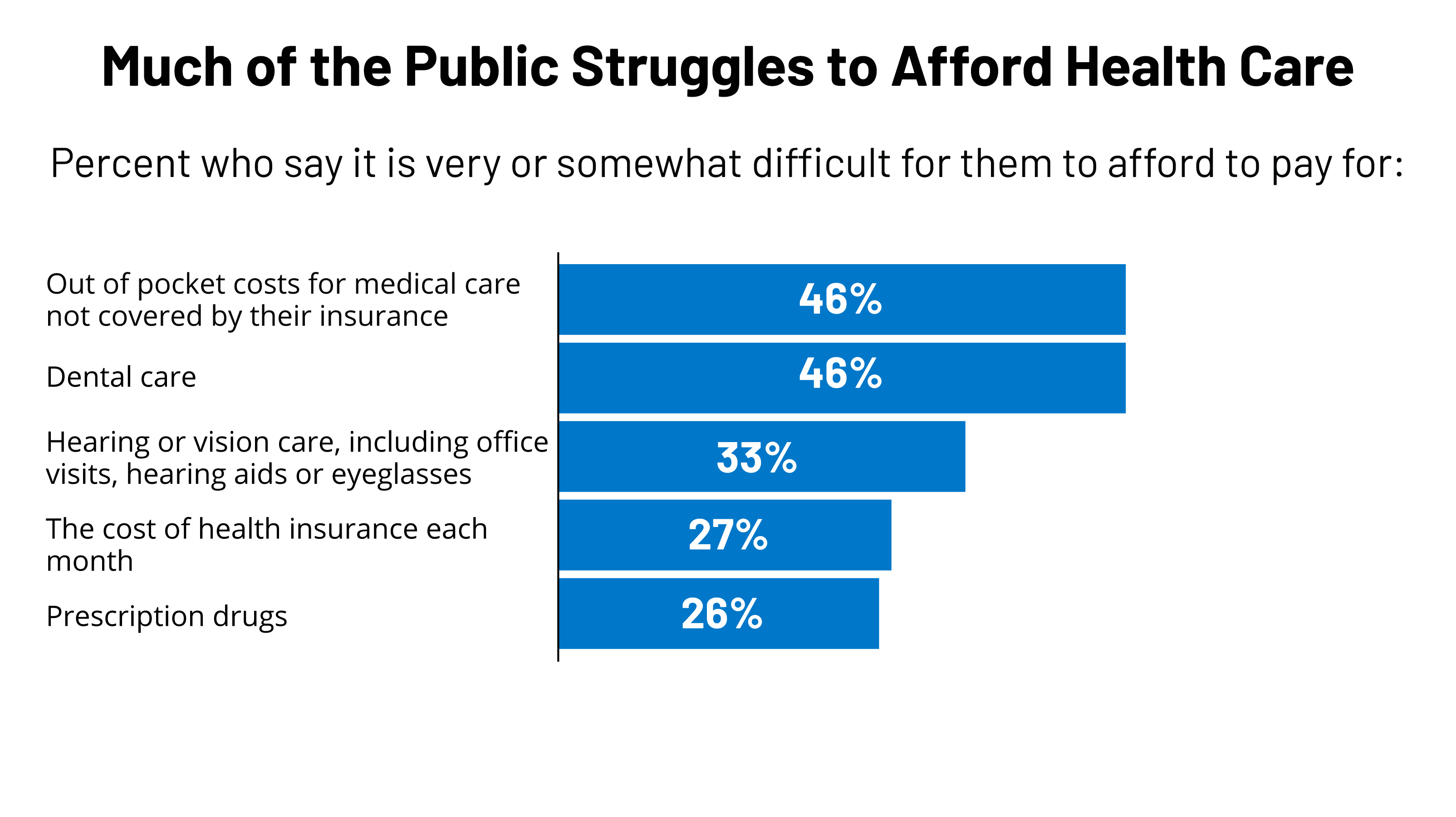

An individual owns a hospital expense policy and a surgical expense policy. In addition one-third of adults in households. AGI is gross income less adjustments.

95 or 1 of AGI -2014 325 or 2 of AGI -2015 695 or 25 of AGI -2016 individual with AGI of 50000 pays penalty of 1250. Ashley has an individual medical expense insurance policy with a 1000 calendar-year deductible and a 20 percent coinsurance clause. In the case above where your AGI is 40000 and your total medical and dental expenses are 5000 you could deduct 2000 of your medicaldental expenses because 2000 is the amount above 75 of your AGI 3000.

Among those under age 65 with health insurance one in four report issues paying medical bills and 12 say it has had a major impact on their lives. If Larrys family files four claims of 400 800 100 and 700 in one year how much will the insurance company pay. An employer-payment plan is a type of account-based plan that provides an employee reimbursement for all or a portion of the premium expense for individual health insurance.

For medical expenses that would have been deductible in an earlier Tax Year you can amend a tax return. A self-employed individual can deduct premiums for medical dental and long-term care insurance for himself or herself a spouse and any dependents provided. A recent study by the Employee Benefits Research Institute EBRI found that a couple retiring today needs a whopping 273000 to have a 90 chance of covering their health care costs in retirement including Medicare.

Of course as with any. The life insurance premiums can be claimed. Ashley has an individual medical expense insurance policy with a 1000 calendar-year deductible and a 20 coinsurance clause.

Larry has a Major Medical Expense policy for his family with a 1000 per familyper year deductible and an 8020 coinsurance provision. Many employers have contacted us over the years asking whether they may offer an employerpayment plan rather than offer a traditional group health insurance plan. Driving recent improvements in individual market insurer financial performance are the premium increases in 2017 and simultaneous slow growth in claims for medical expenses.

The hospital policy pays 100 a day for hospital room and board and a maximum of 1000 for miscellaneous hospital charges. The surgical policy pays a maximum of 500 for any one operation.

What Can Life Insurance Do For You And Your Family This User Generated Word Cloud Lets You Life Insurance Quotes Life Insurance Facts Life Insurance Marketing

Homeworkmade Ashford Hrm 610 Week 4 Discussion 2 Discretionary Benefits Wlo 2 Clos 1 2 4 99 Https Www Homeworkmade Com Ash Ashford Discuss Benefit

Release Form Free Printable Documents Photography Release Form Photography Model Release Form Photo

Excited To Share This Item From My Etsy Shop Printable Life And Health Insurance License Exam Bundl Life And Health Insurance Practice Exam Insurance License

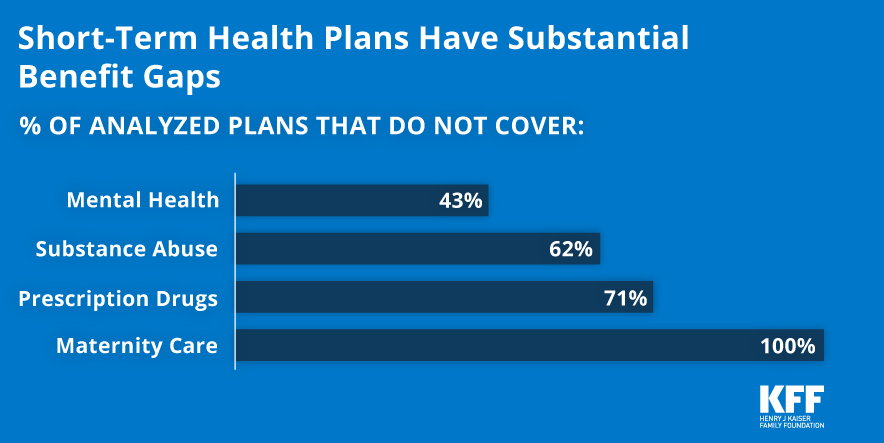

Understanding Short Term Limited Duration Health Insurance Kff

The Faults In No Fault How Lawsuits Medical Bills Help Drive Up Detroit S Auto Insurance Costs

Understanding Evaluating Employer Provided Insurance Benefits

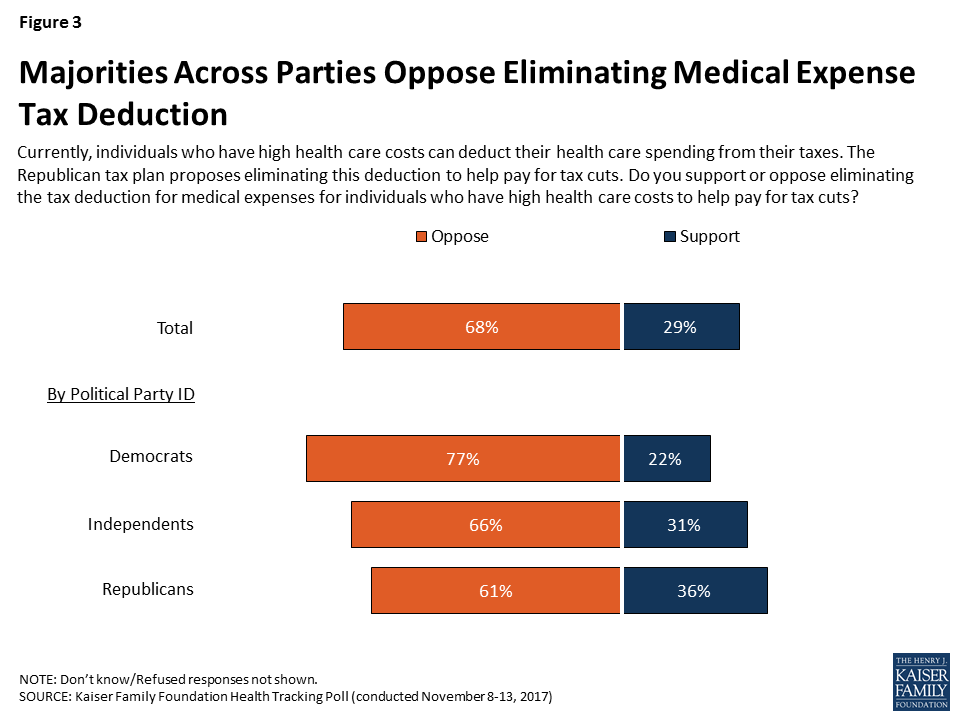

Kaiser Health Tracking Poll November 2017 The Role Of Health Care In The Republican Tax Plan Kff

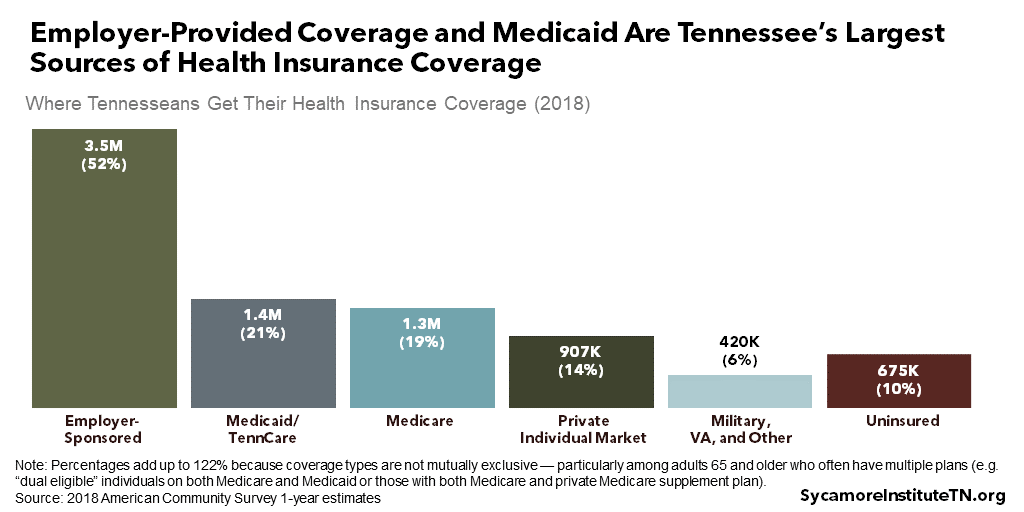

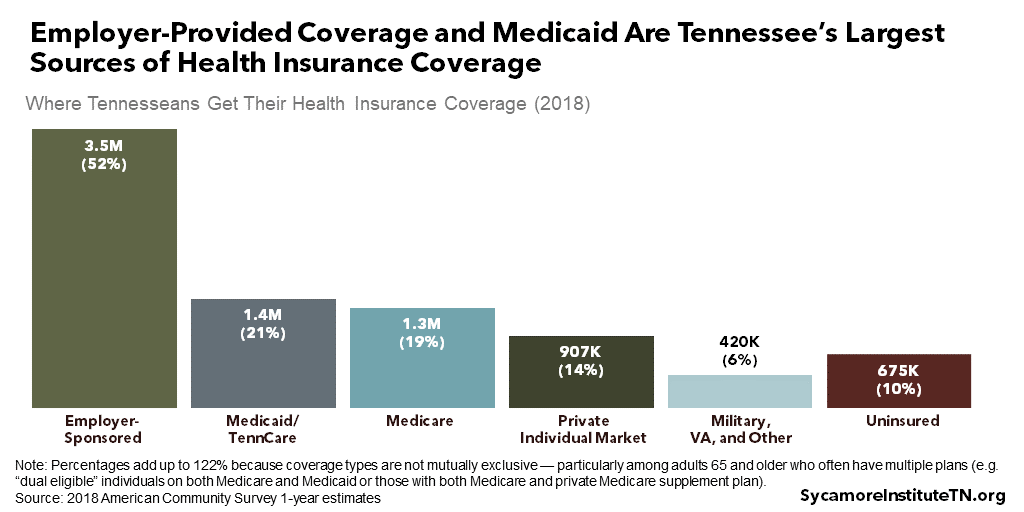

A Deep Dive Into Health Insurance Coverage In Tennessee

Solved A Define The Term Deductible In An Insurance Chegg Com

Individual Insurance Market Performance In 2017 Kff

Americans Challenges With Health Care Costs Kff

Dave Ramsey An Hsa Can Be A Helpful Tool For A Lot Of People Check Out Our 2 Minute Assessment To Find Out If One Is Right For You Https Bit Ly 33ubevy Facebook

6 Exceptions To Paying Tax On Forgiven Debt Creditcards Com Paying Taxes Compare Credit Cards Forgiveness

Write Appeal Letter For Car Insurance Claim Template Rejected Ask Readers Why Life Gets Writing A Cover Letter Letter Templates Cover Letter For Resume

Budgeting 101 The Unfabulous Blog Simple Budget Budgeting Budgeting Money

When Are Car Insurance Settlements Taxable Insurance Com

4 Types Of Businesses Business Basics Business Marketing Plan Simple Business Plan

Comments

Post a Comment